1. About this documentation

1.1. Target group, purpose of the documentation, and prerequisites

This documentation is aimed at integrators of the DB Merchant Solutions REST API to provide the necessary knowledge to connect their application to the DB Merchant Solutions REST API.

Readers are advised to have basic technical programming knowledge as well as basic knowledge about electronic payment transactions.

1.2. Support contact

Please ask Deutsche Bank customer support for the support contact.

1.3. Formatting

Source code

Source code examples are formatted as follows:

#!/bin/bash

# endless loop

while [ true ]

do

clear;

free;

sleep 1;

doneParameters

All parameter designations appear in the following font: parameter.

Highlighted text

Significant words and essential information requiring emphasis appear in italics.

1.4. Disclaimer

The information in this document has been compiled with the utmost diligence. However, the documentation neither claims completeness nor accuracy. VÖB-ZVD Processing GmbH, a subsidiary of Deutsche Bank AG, therefore neither assumes liability for usability or correctness nor - as far as legally allowed - for direct, indirect, accidental or consequential damage arising from the use of the information provided in this document. Except for cases of intention and gross negligence, liability is excluded for errors in translation as well as damages resulting from this.

1.5. Copyright note

This document is copyright protected. The use of text and images, even excerpts, without the prior written permission of VÖB-ZVD Processing GmbH, a subsidiary of Deutsche Bank AG, is a copyright offence. This applies in particular to reproduction, translation or use in electronic systems.

All rights reserved © 2026.

1.6. Trademarks

The product names used in this documentation are for identification purposes only.

All trademarks and registered trademarks are the property of their respective owners.

1.7. Changes to the document

This document is updated regularly. It contains changes up to and including 2026-02-18. See the Changelog for details.

2. Introduction

2.1. Supported services

DB Merchant Solutions REST API offers merchants a wide range of payment methods and related services for their web shop:

-

payment methods:

-

credit cards: Mastercard and Visa

-

Google Pay™

-

Apple Pay®

-

SEPA Direct Debit (SDD)

-

PayPal

-

Request to Pay (RtP)

-

Klarna

-

P24

-

TWINT

-

WeChat Pay

-

iDEAL

-

Wero

-

-

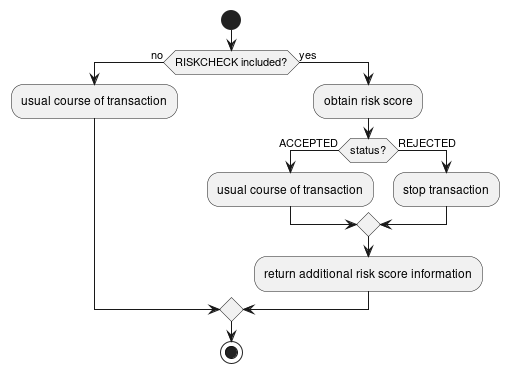

fraud prevention:

-

verify credit card data and bank account data before use

-

check SDD transactions against a negative list to avoid fraud

-

perform a risk assessment for credit card or SDD transactions to automatically decline high-risk transactions

-

use eScore for address verification, credit assessment, and scoring

-

-

compliance:

-

create an alias for credit card or bank account data to simplify compliance to the PCI DSS standard

-

-

further services:

-

support multi-currency pricing

-

retrieve bank account information via PSD2 AIS

-

retrieve information about previous transactions

-

See User guide for details on using these services.

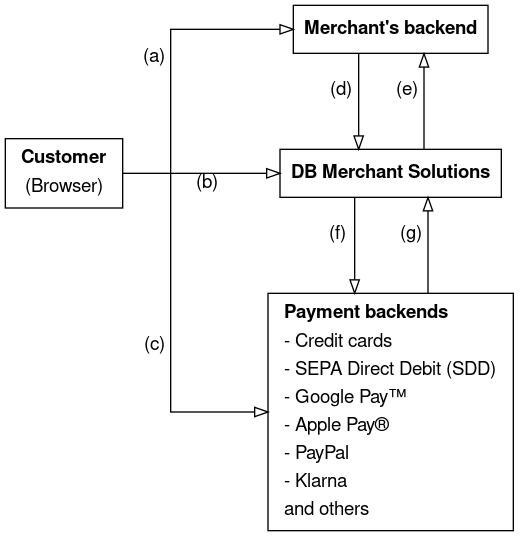

2.2. Architectural overview

In the following, a short overview is given about the actors and components of DB Merchant Solutions REST API and how they communicate.

DB Merchant Solutions provides a common access point to various payment methods. Therefore, merchants can offer several payment methods to their customers by integrating only one payment service provider. The merchant’s server communications only with DB Merchant Solutions and not with the various backend systems (there is one exception for Apple Pay, see Transaction processing for Apple Individual Integration).

The actors in the following diagram are:

-

The customer who uses a web browser or a mobile app to access a merchant’s shop.

-

The merchant’s backend: a server which handles the shop’s business logic.

-

DB Merchant Solutions where the merchant’s backend delegates the payment-relevant business logic.

-

The payment backends where the payment transactions are carried out.

Arrows mean "sends a requests to".

The functions of the requests (arrows) in the above figures are:

-

The customer uses the merchant’s website and accesses business entities like offers and baskets.

-

The customer communicates directly with DB Merchant Solutions REST API.

-

The customer communicates directly with some of the backends to authenticate to the payment method among others.

-

The merchant’s backend uses payment related business logic of DB Merchant Solutions, for example: authorize payments.

-

DB Merchant Solutions may call the merchant’s backend to notify about the outcome of a transaction.

-

DB Merchant Solutions calls the payment backends to process payment relevant tasks.

-

The payment backends may call back DB Merchant Solutions.

2.3. Transactions

Transactions are the basic principle to provide the services described in Supported services. All the transaction in DB Merchant Solutions REST API are initiated using the endpoints in Services API. Most of the endpoints given there refer to various kinds of financial transactions where the payment backends of various payment methods are involved (see Supported transaction kinds). The payment backends are responsible for the legal processing of the transactions which are therefore recorded there.

DB Merchant Solutions REST API provides a common access point to the payment systems and therefore also records the transactions within its own system.

2.3.1. Transaction IDs and event IDs

DB Merchant Solutions REST API assigns a unique identification number to each transaction which is

called transaction ID (tx_id in Services API).

When a customer of a merchant’s web shop starts a payment for some goods or a service, the merchant has to associate their own business processes with the transactions in DB Merchant Solutions REST API.

This is handled using event IDs. The event ID is assigned by the merchant’s backend systems and is subject to their own naming conventions as long as it satisfies the rules specified in Services API.

Event is considered as a payment event and therefore has to be unique for each payment process. Several transactions may be associated with an event, but only one successful initial payment (see Transactions kind details). There may be several attempts to pay with different means of payment, one of which is successful. The unsuccessful and the successful payments each relate to a transaction.

Also, a transaction may have subsequent transactions (refunds, reversals, or captures).

All those transactions are associated with the same event.

The event_id is used for most endpoints in Services API.

2.3.2. Status and response codes

A (payment) transaction is initialized by the merchant, or the merchant’s backend, respectively. In many cases a transaction requires the customer’s interaction, for example to confirm a payment in the payment method’s system.

The merchant needs to be informed on the outcome of the transaction, or, more generally, its status. The way this status is transferred to the merchant depends on the integration type, or the merchant’s preference (for example Callback and diagnosis request for Form service).

In any case, the status information is contained in the response code which is denoted rc in all

API responses in Services API and API requests in Callback API.

As described in Response codes, rc = 0 means success and other response code indicate

that either the transaction is still pending or not successful.

The value of rc gives further information about the status.

In some situations, a backend response code (back_rc) is given which contains status information on the

transaction in the nomenclature of the involved payment backend.

For some payment methods the back_rc reveals additional information on the transaction status.

This is than described the specific payment method’s chapter in Payment methods.

2.3.3. Supported transaction kinds

DB Merchant Solutions REST API supports several types of financial transactions which are

called transaction kinds in the following.

The transaction kind is coded as tx_action in Services API.

The different payment methods each support a subset of the following transaction kinds:

-

authorization: (direct) payment for a transaction, either for a single transaction (standard) or recurring

-

pre-authorization: reservation for a transaction which will be fulfilled later

-

capture: payment for a pre-authorization when the transaction has been fulfilled

-

refund: credit transaction for a previous authorization or capture

-

credit: credit transaction without a previous authorization or capture

-

reversal: (partial) cancellation of a previous transaction

-

verify means of payment (MOP) (also see Alias referencing a billing agreement)

When captures, refunds, and reversals are supported by a payment method, one or more following three variants are possible:

-

full: The exact original amount has to be paid in a single transaction.

-

single partial: The original transaction allows only a single payment, but its amount can be smaller than the original amount.

-

multiple partial: The original amount can be split in several amounts which are handled in separate payments. "multiple partial" implies "single partial".

See transaction kind details for a detailed explanation of these transaction kinds.

The following table shows which payment methods support which transaction kinds.

| Payment method | Authorization | Pre-Authorization | Capture | Refund | Reversal | Credit | Verify MOP |

|---|---|---|---|---|---|---|---|

Credit card |

standard + recurring |

✔ |

full + single partial |

full + single partial |

full + single partial |

✔ |

✔ |

Google Pay |

standard + recurring |

✔ |

full + single partial |

full + single partial |

full |

✔ |

|

Apple Pay |

standard + recurring |

✔ |

full + single partial |

full + single partial |

full |

✔ |

|

Direct debit |

standard + recurring |

✔ |

full + multiple partial |

full + multiple partial |

full + single partial |

✔ |

✔ |

PayPal |

standard + recurring |

✔ |

full + multiple partial |

full + multiple partial |

full |

||

Request to Pay |

standard |

full + multiple partial |

|||||

Klarna |

standard + recurring |

✔ |

full + multiple partial |

full + multiple partial |

full + single partial |

||

P24 |

standard |

full + multiple partial |

|||||

TWINT |

standard |

full + multiple partial |

|||||

WeChat Pay |

standard |

full + multiple partial |

|||||

iDEAL |

standard |

||||||

Wero |

standard |

✔ |

full + multiple partial |

full + multiple partial |

2.3.4. Anti Financial Crime check

Payment transactions underlie regulations and policies to prevent money laundering and other financial crimes.

Within DB Merchant Solutions REST API payment transactions may therefore be blocked due to Anti Financial Crime (AFC) checks.

This results in specific response codes which are listed in Response codes.

2.4. Aliases and recurring payments

2.4.1. Aliases referencing sensitive data

Within DB Merchant Solutions REST API an alias is a reference to a means of payment. A means of payment is an instance of a payment method which contains a legal contract for processing money transactions, for example a credit card, bank account, or a PayPal account.

While modern means of payment (made for ecommerce) prevent misuse by requiring customer authentication, the traditional means of payment credit card and SEPA bank account can be subject to fraud, if their data (PAN or IBAN) falls into the wrong hands. Therefore, this sensitive data must be handled with special care. For credit card this manifests in the PCI DSS regulation.

For traditional means of payment, an alias is a way to reduce the due dilligence effort for a merchant who wants to store a customer’s credit card or bank account for later usage (for example, to offer a "pay with" link for checkout).

The alias for the means of payment is created on a website hosted by DB Merchant Solutions REST API. The customer enters the sensitive data there, and only the alias is provided to the merchant. Therefore, the due diligence, as demanded by PCI DSS, lies with DB Merchant Solutions.

The alias is used in several endpoints of DB Merchant Solutions REST API to initialize payments.

2.4.2. Recurring payments

For credit card and SEPA direct debit (bank account), a merchant can withdraw money from the customer using the payment API without further customer interaction or permission. For credit card, this is legally possible for Mail Order/Telephone Order (MOTO) transactions (where the customer permission has been given but not technically proven).

In all other situations, the merchant has to provide a billing agreement of the customer to initialize merchant initiated transactions (MIT). These billing agreements must be authorized by the customer.

Billing agreements are used to authorize recurring payments. These may be withdrawn periodically by the merchant for a magazine subscription or a periodical service, or on an unscheduled basis with a varying amount.

For SEPA direct debit the billing agreement is called SEPA mandate. The merchant is responsible for getting it from the customer and to comply with regulation.

For credit card, the billing agreement is accomplished by an initial transaction authorized by the customer. A reference to the initial transaction is used in (subsequent) MIT transactions, together with the corresponding credit card alias.

The reason to separate the alias from the initial transaction is the following: When the

credit card expires, a new alias with same number and a new expiry_date has to be created

for a subsequent transaction.

It is possible that the acquirer then accepts the payment with the same initial transaction.

For details, the merchant has to contact Deutsche Bank customer support and his acquiring bank.

The initial transaction may involve a money transfer (authorization or pre-authorization) itself, or may consist of the authorization for the billing agreement alone.

The latter case is associated with the transaction kind verify means of payment (verify MOP).

2.4.3. Alias referencing a billing agreement

Modern payment methods, like PayPal or Klarna, don’t require an alias as a reference to sensitive data: Customers simply have to log in to their account and authorize the payment there.

Here, aliases are referencing billing agreements:

For the payment methods PayPal and Klarna the customers authorize the payment method to withdraw payments from their account. The technical reference to the authorization is stored within DB Merchant Solutions REST API and is referenced by the alias. The alias is used in the payment API to initialize MIT.

As for credit card, the authorization for a billing agreement may be contained in

an initial money transaction (authorization or pre-authorization) or not.

The latter case is also associated with the transaction kind verify MOP (verify-mop).

For Google Pay and Apple Pay are wallets which contain customers' credit cards. Here, the customers authorize access to their credit card which then are used to create the initial transaction which authorizes recurring payments (see Recurring payments).

2.4.4. API usage

Creation of aliases

Aliases can be created in the following ways (supporting different payment methods):

-

Alias API for credit card and bank account.

-

Alias endpoints in Form service: bank account, credit card.

-

Using the field

alias_actionin the payment method specific endpoints of Form service: direct debit, credit card, PayPal, and Klarna.For PayPal and Klarna, the alias references a billing agreement which can be used for an MIT (see Alias referencing a billing agreement).

The transaction kind

tx_action=verify-mopis used to create an alias without initial transaction. -

Using the field

alias_actionin Widget Solution for PayPal, Google Pay, and Apple Pay. -

Using the field

alias_actionin Headless 3-D Secure endpoints for credit card.

For credit card, the initial transaction for recurring payments can be created using 3, 4 (via Google Pay or Apple Pay) or 5.

Refer to the payment method specific documentation in Payment methods for details.

Using an alias for MIT

The payment method specific endpoints in the Payment API are used to authorize MIT: credit card (including Google Pay and Apple Pay), Klarna, and PayPal.

Inspecting, deleting, and updating alias

For Aliases referencing sensitive data some additional endpoints are contained in the Alias API.

For Klarna it is possible to repace an existing alias using action = CREATE

in alias_action. This means that an existing alias then references a new Klarna billing agreement.

For all other payment methods, it is necessary to delete an alias in order to use it for another means of payment.

2.4.5. Uniqueness aspects

Primary keys

In principle, an alias must be unique for a means of payment and a means of payment must be unique for an alias:

-

An alias (given by its name) can not be used for more than one means of payment.

-

A means of payment can not be referenced by more than one alias.

This is true within the context of a merchant’s shop: To different shops can each create an alias for the same means of payment or create an alias with the same name for different means of payment.

Therefore, the fields are important that uniquely identify a means of payment (the "primary key"). These are the following:

| Payment method | Primary key | Remark |

|---|---|---|

Credit card |

|

A new |

Bank account |

|

|

PayPal |

PayPal identifier of an automatic payment |

Typically, one automatic payment per Google customer account and merchant. Changes only after deletion and recreation. |

Klarna |

Klarna identifier of a token |

Several tokens per Klarna customer account and merchant. |

Within DB Merchant Solutions REST API, the primary key is the combination of the merchant’s shop and the primary key of the means of payment.

The consequences concerning recurring payments are the following:

| Payment method | Consequence for billing Agreements | Consequence for alias management |

|---|---|---|

Credit card |

Different billing agreements using the same credit card must use the same alias. Different initial transaction may be used. When the credit card expires, a new alias has to be created for the billing agreement. |

Two shop users who share a credit card also have to share an alias. No different alias representing the shop customers can be used. |

SDD |

The same bank account alias has to be used for different billing agreements. |

Two customers using the same bank account have to be associated the same alias. |

PayPal |

Different billing agreements of the same PayPal account must use the same alias. |

Two shop users who use the same PayPal account also have to be associated with the same alias. |

Klarna |

Different billing agreements can use different aliases for the same shop customer. |

If the same Klarna account is used for different shop users, then it’s possible to use different aliases. |

Naming of aliases

The name of an alias (meaning its unique identifier) is contained in the field alias

of the requests and responses of DB Merchant Solutions REST API.

All endpoints for the creation of an alias (see Creation of aliases) allow to omit this field. In this case, the name of the alias is chosen by the DB Merchant Solutions REST API. It is returned to the merchant in the Callback request or the corresponding response. It can also be queried using the Diagnosis request.

The following issues have to be considered if the alias is specified:

For Alias API: The transaction fails if an alias for the given means of payment exists. This is true for both cases: The name of the existing alias coincides with the name given in the request or not.

For all other ways to create aliases (see Creation of aliases):

-

The transaction fails if another alias with a different name exists for the means of payment given by the customer or specified in the request.

-

The transaction succeeds if an alias with the same name exists for the means of payment given by the customer or specified in the request. The fields not belonging to the primary key of the alias are updated (like the

cartholderfor credit card).

The following issues have to be considered if the alias is omitted:

For Alias API: The transaction fails if an alias for the given means of payment exists.

For all other ways to create aliases (see Creation of aliases):

-

If an alias for the means of payment (given by the customer or specified in the request) already exists, this alias is returned to the merchant (in the callback or response). Fields not belonging the primary key are updated.

-

A new alias is created for a new means of payment (which does not yet exist for the merchant’s shop).

-

For Widget Solution, the alias has to be omitted (in the field

alias_action), otherwise the fieldaliasis ignored. The alias is chosen by DB Merchant Solutions REST API in any case.

|

If |

3. Integration types

DB Merchant Solutions REST API offers five integration types for payments for a merchant:

Integration types provide different approaches to integrate payment services into a merchant’s E-Commerce application. This chapter describes various aspects of the integration. Common aspects are described in the User guide.

The following table presents a brief comparison of the five payment integration types.

| Shop plug-ins | Form service | iFrame Service | Widget Solution | Direct integration | |

|---|---|---|---|---|---|

Supported payment methods |

credit card, direct debit, PayPal, Request to Pay, Google Pay, Apple Pay, iDEAL |

credit card, direct debit, PayPal, Request to Pay, Google Pay, Apple Pay, Klarna, P24, TWINT, WeChat Pay, iDEAL, Wero |

credit card, direct debit |

Google Pay, PayPal, Apple Pay |

credit card (including Google Pay and Apple Pay), direct debit, Klarna |

OpenAPI label(s) |

not applicable |

Forms, Payment Link |

iFrame |

Widget Solution |

Payment, Google Pay, Apple Pay, Headless 3-D Secure |

Basic idea |

For merchants who already use one of the supported shop-systems. |

For entry of sensitive payment data, the merchant will redirect the customer to a customizable frontend page of DB Merchant Solutions. After receipt of the necessary information, the DB Merchant Solutions frontend will carry out the transaction and redirect the customer back to the merchant’s page. |

The merchant can embed specific elements of the DB Merchant Solutions frontend into their own web page. Entry of sensitive data is done in these elements so that they can be sent to DB Merchant Solutions without the merchant ever being in contact with it. After receipt of the data by DB Merchant Solutions, the merchant will be informed and can trigger the transaction processing towards DB Merchant Solutions via an API call. |

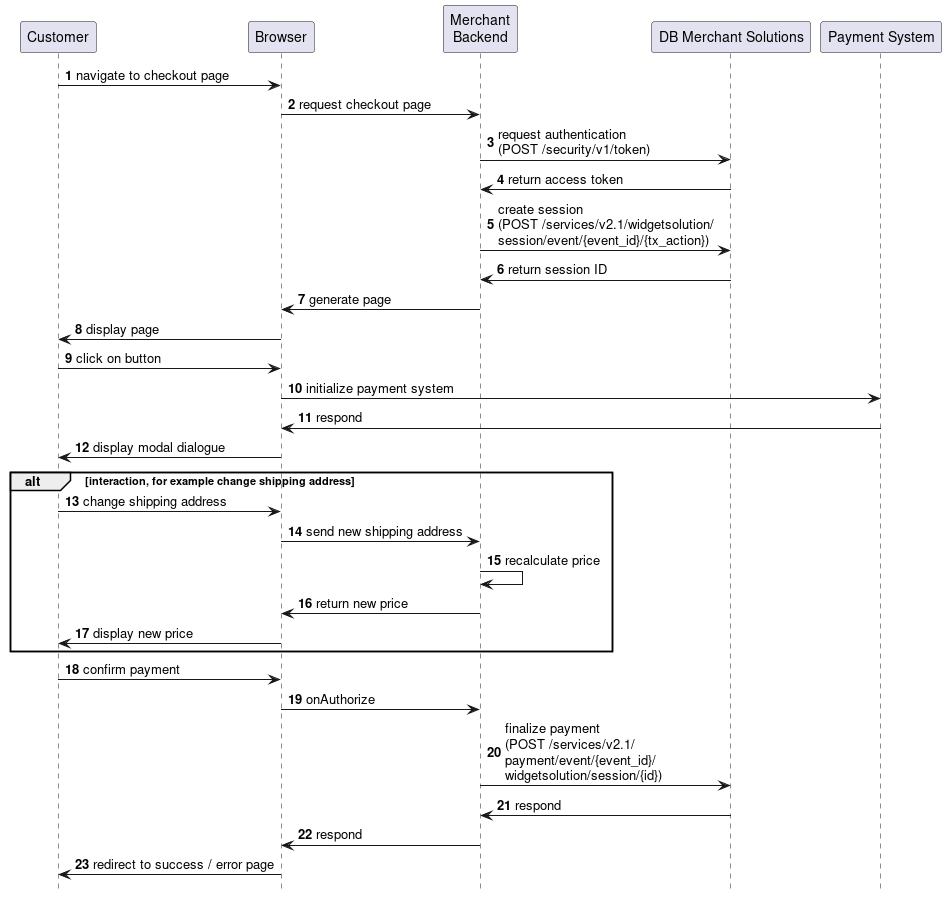

The merchant can embed a widget into their own web page, which opens a modal dialogue for paying with the chosen payment system. |

The merchant is only integrated to DB Merchant Solutions at the backend. All use cases are triggered via an API call. It is the merchant’s responsibility to collect all relevant payment data via their own frontend. |

PCI DSS compliance level required when supporting credit cards |

SAQ A |

SAQ A |

SAQ A-EP |

SAQ A-EP |

SAQ D-Merchant |

Complexity of integration |

Only installation and configuration of plug-in necessary. |

Integrate API to DB Merchant Solutions backend. Also minimal redirect logic at the frontend. |

Integrate API to DB Merchant Solutions backend. Also integrate DB Merchant Solutions elements directly into merchant’s web page. |

Integrate API to DB Merchant Solutions backend. Also integrate DB Merchant Solutions elements directly into merchant’s web page. |

Only integrate API to DB Merchant Solutions backend. |

Customization |

DB Merchant Solutions pages can be minimally customized. |

DB Merchant Solutions pages can be customized, the basic structure is fixed. |

DB Merchant Solutions elements can be customized. The merchant can freely decide on the integration of these elements in their own web page. |

The frontend is completely under control of the merchant. |

The frontend is completely under control of the merchant. |

Recommended for |

Merchants who use one of the supported shop-systems. |

Merchants who want to achieve a simple integration. |

Merchants who want to achieve seamless integration in the checkout process. |

Merchants who want to offer express checkout (with seamless integration). |

Merchants who want to have full control of the integration (and who are PCI DSS compliant for credit card transactions). |

Additional functionality offered by DB Merchant Solutions REST API, like eScoring services and management functionality for risk management, can be integrated directly by calling the corresponding REST endpoints. In the OpenAPI specification, these can be found under the labels Alias, eScore, Info, and Risk Management.

SDKs for web and mobile development. DB Merchant Solutions REST API provides web software development kits (SDKs) for web shops for the languages

-

C#

-

Go

-

Java

-

PHP

-

Ruby

to facilitate the development. The SDKs contain a client implementation which supports among others

-

easy authentication

-

high-level requests which encapsulate REST requests

-

convenience methods for dealing with IDs.

The following example shows a Form service request for an SDD payment with the Java SDK.

// create configuration

Configuration configuration = new Configuration(CLIENT_ID, CLIENT_KEY_TEST);

configuration.setMerchantId(MERCHANT_ID);

configuration.setApiBase(BASE_URL_TEST);

configuration.setDefaultCurrency("EUR");

// initialize client and authenticate

DirectposClient client = DirectposClient.create(configuration);

// create forms payment

FormPayment payment = client.payment()

.build()

.amount(100)

.forms()

.callback(new Callback(CALLBACK_URL))

.formCustomerContinuation(new FormCustomerContinuation(SUCCESS_URL))

.use()

.directDebit()

.mandate(new Mandate("MDT1620213727383XY", LocalDate.of(2020, 12, 30), MandateType.PROVIDED))

.use()

.create().toFormPayment();The web SDKs support all payment methods except iDEAL.

DB Merchant Solutions REST API also provides mobile SDKs, which facilitate integrating Google Pay on Android devices and Apple Pay on iOS devices.

Contact Deutsche Bank customer support to obtain them.

3.1. Shop plug-ins

DB Merchant Solutions REST API offers plug-ins for the following shop systems:

All shop plug-ins support the following payment methods:

-

Credit card

-

SEPA direct debit

-

PayPal

-

Request to Pay

-

Sofortüberweisung

-

Google Pay

-

Apple Pay

-

iDEAL.

To install a shop plug-in, follow the instructions in the included file readme.en. Typically, the integration requires only the following steps:

-

Upload the module to the shop server plug-in directory and grant permissions.

-

Activate the plug-in in the backend.

-

Enter

client_keyandclient_secretas configuration parameters. -

Configure certain payment methods parameters as desired.

See the readme.en and the tooltips on the configuration page for more information.

3.2. Form service

The Form service integration type requires minimal integration effort for the merchant: For the payment (or payment-related) process, the customer communicates directly with DB Merchant Solutions. DB Merchant Solutions handles all necessary communication with the customer and the backend systems. After the transaction, the transaction result and all necessary information are passed to the merchant and the browser session is returned to the merchant’s website. For details, see Course of transaction.

DB Merchant Solutions Form service offers two main functionalities:

-

Form service with choice of payment method (checkout page): Using the checkout endpoint, display a (highly configurable) checkout page where the customer may select a payment method. The customer then has to enter specific information for the chosen payment method in a specific form.

When only one payment method is used for the checkout endpoint and this is not Google Pay or Apple Pay, the selection page is skipped and the payment method is directly invoked (having the same behavior as for 2). For Google Pay or Apple Pay, a selection page containing the single payment method is offered.

-

Form service for an already selected payment method: Using one of the dedicated endpoints under

/form, directly display the form for the payment method. This can be used for shops where the customer has already selected the payment method at the shop.For Google Pay or Apple Pay this dedicated endpoint is not available.

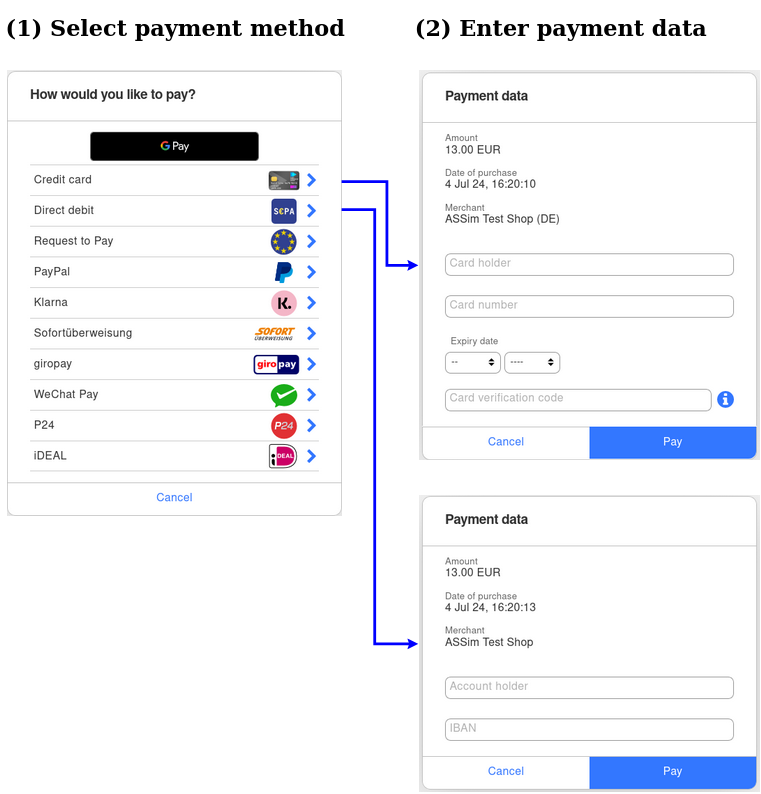

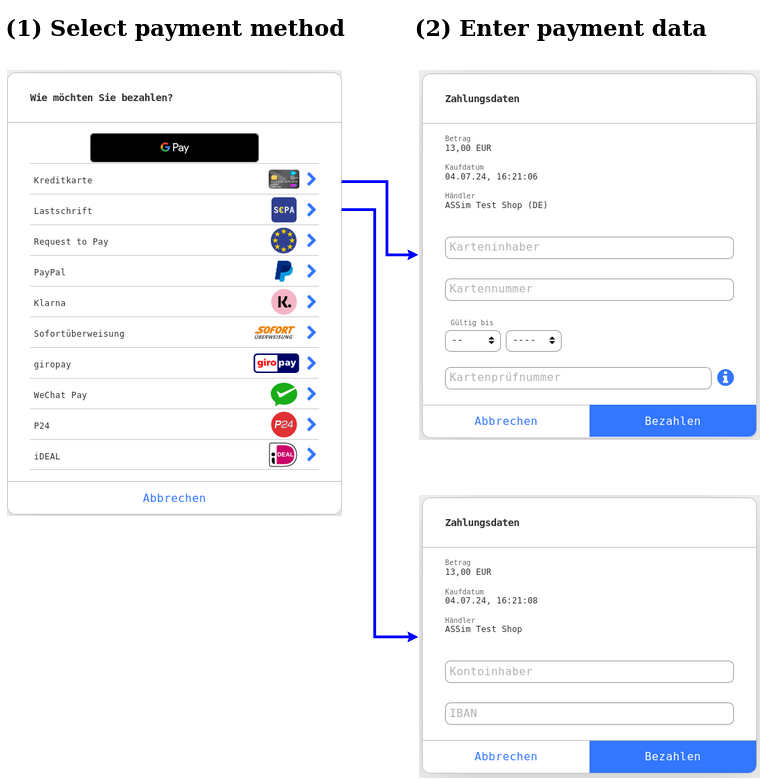

The following image shows the checkout page and the forms after selecting credit card and Wero.

3.2.1. Selection of payment methods in the checkout page

The customization which payment methods shall be displayed is done in the field checkout_page_configuration

of the checkout endpoint:

-

For each payment method offered, set the field

<payment_method>_data. For example, to offer paying by credit card, PayPal, or Wero, set the three fieldscredit_card_data,paypal_data, andwero_data. The field<payment_method>_datatypically contains additional fields specific to the payment method, but may also contain no fields, indicating that the payment method shall be offered but does not have additional parameters. -

For each payment method offered, add the corresponding entry to the field

checkout_entry_sorting_orderto indicate its display position (from top to bottom). In the example above,"checkout_entry_sorting_order": ["CREDITCARD", "PAYPAL", "WERO"]displays the payment options from top to bottom as credit card, PayPal, and Wero.Due to guidelines for the integration of Google Pay, this payment method is always displayed at the top of the list. checkout_entry_sorting_orderapplies only to the remaining entries.

3.2.2. Supported currencies

When using the checkout page, the transaction currency must be supported by all payment methods the merchant wants to be displayed so that the user experience during checkout is not negatively affected.

For example, DB Merchant Solutions REST API will return an error message if a merchant submits a transaction in USD and one of the offered payment methods supports only transactions in EUR.

3.2.3. Transaction kinds

DB Merchant Solutions REST API supports the payment methods shown in Supported transaction kinds. Via the Form service, the initial transaction kinds authorization, pre-authorization, and verify MOP are supported. The transaction kinds pre-authorization and verify MOP are supported in the checkout page only if all offered payment methods support this transaction kind.

For subsequent transactions, that is capture, reversal, and refund, use the general subsequent transaction endpoint.

Note that the transaction kind credit is only supported via the Payments API.

3.2.4. The Form service and PCI DSS

Since the forms in which a customer enters their credit card details are hosted by DB Merchant Solutions REST API and not the merchant, the merchant does not need to store the credit card details. This allows to save time and costs by not having to participate in the “Payment Card Industry Data Security Standard” (PCI DSS) program by Visa and Mastercard as the participation in the PCI program happens centrally via DB Merchant Solutions.

3.2.5. Use of cookies

The Form service uses session cookies to support navigation through the different forms. These session cookies are first-party cookies and are strictly necessary in the sense of the General Data Protection Regulation (GDPR), which is applicable in the European Union and the UK. As the cookies do not gather personal information, a user consent therefore is not required.

3.2.6. Customization

The display of the payment method selection and the payment method specific forms are customizable:

-

Set the labels to different languages by using the corresponding locale. For available locales see FormData. Moreover, custom labels are supported by directly specifying the label. For the supported labels see FormLabel and the following examples.

-

Use CSS form theme properties to alter the appearance of the forms. For the supported theme properties see section FormThemeProperty and the following examples. In particular, use the key

SHOP_LOGO_VISIBLEto display a configured shop logo andSHOP_NAME_IN_HEADLINEto display the shop name in the headline.

| The customization applies only to form pages which are provided by DB Merchant Solutions REST API. For several payment methods, external pages are used which are subject to separate rules. |

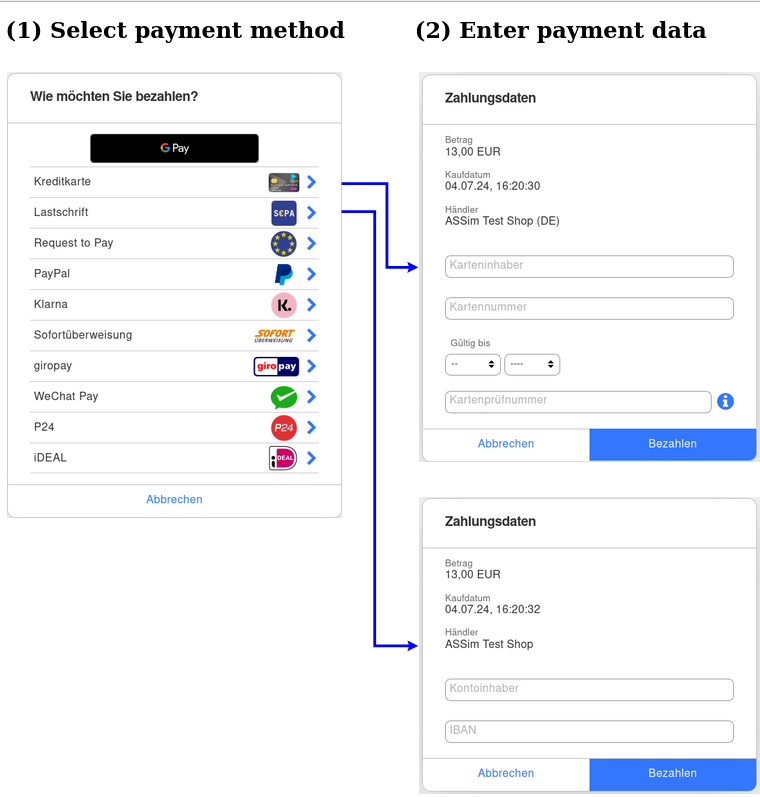

Example: Using locale = de

When setting locale = de, all pages displayed by the Form service have German labels and messages.

For example, the checkout page and the forms for credit card or Wero appear as follows.

Example: Using custom labels

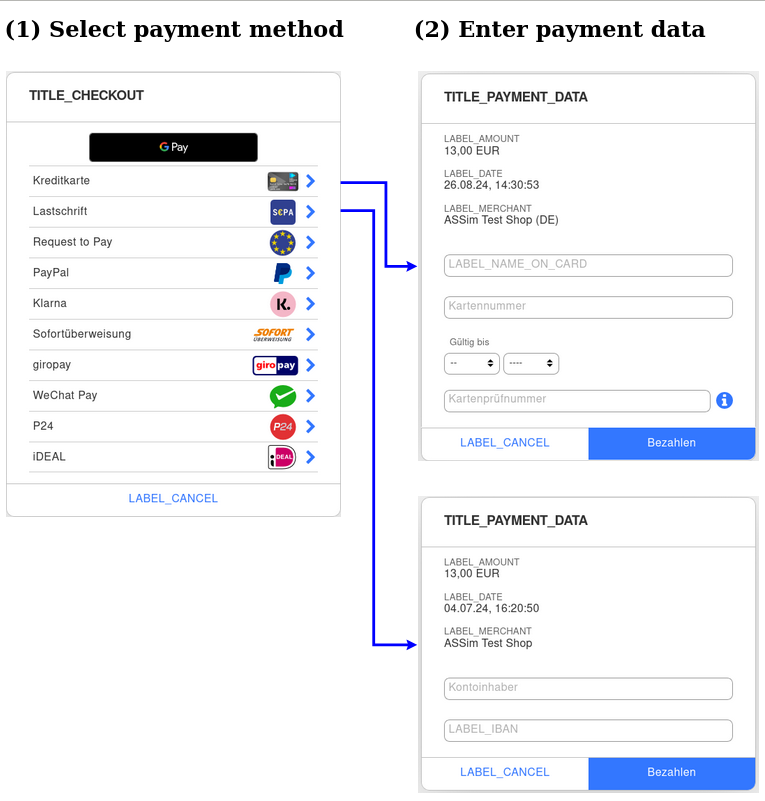

When setting locale = de and using custom labels (see below), the appearance is as follows (with credit card and Klarna chosen as payment methods).

Note that the German title has been replaced by "TITLE_CHECKOUT", the cancel button has the label "LABEL_CANCEL", and similarly for the other labels.

This can be achieved by submitting in form_data.label the corresponding key-value pairs, in the above case as follows.

"form_data": {

"locale": "de",

"label": [

{"key": "TITLE_CHECKOUT", "value": "TITLE_CHECKOUT"},

{"key": "LABEL_CANCEL", "value": "LABEL_CANCEL"},

{"key": "TITLE_PAYMENT_DATA", "value": "TITLE_PAYMENT_DATA"},

{"key": "LABEL_AMOUNT", "value": "LABEL_AMOUNT"},

{"key": "LABEL_DATE", "value": "LABEL_DATE"},

{"key": "LABEL_MERCHANT", "value": "LABEL_MERCHANT"},

{"key": "LABEL_IBAN", "value": "LABEL_IBAN"},

{"key": "LABEL_NAME_ON_CARD", "value": "LABEL_NAME_ON_CARD"}

]

}The other possible labels can be used to customize the appearance of subsequent dialogues. For example, when a customer cancels the payment, the following labels can be customized:

Example: Using form theme properties

To change theme properties of the forms, for example the font family, set the corresponding selector to the desired value.

The following snippet will display a monospaced font in the forms:

"form_data": {

"theme_properties": [

{"selector": "GLOBAL_FONT_FAMILY", "value": "monospace"}

]

}

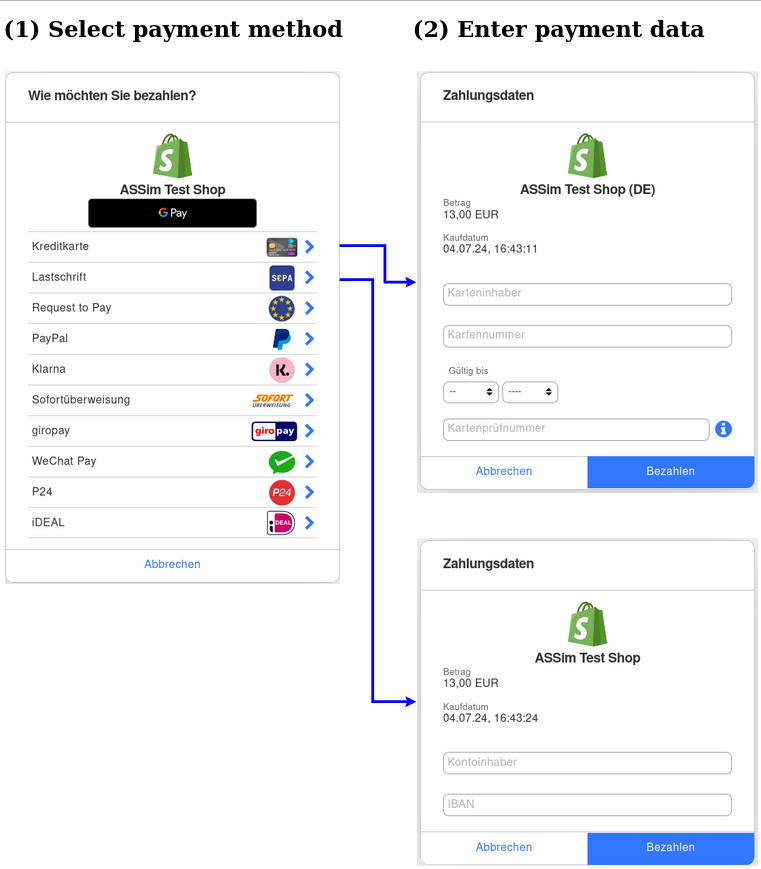

Example: Display a shop logo and the shop name in the headline

To display a shop logo and a shop, upload a shop logo and set the corresponding selectors as follows.

"form_data": {

"theme_properties": [

{"selector": "SHOP_LOGO_VISIBLE", "value": true},

{"selector": "SHOP_NAME_IN_HEADLINE", "value": true}

]

}

The logo will be displayed during the following Form service calls:

-

checkout page (all payment methods)

-

credit card

-

SDD

-

Klarna.

3.2.7. Payment method specific information

Credit card transactions

3-D Secure transactions and the uplift feature

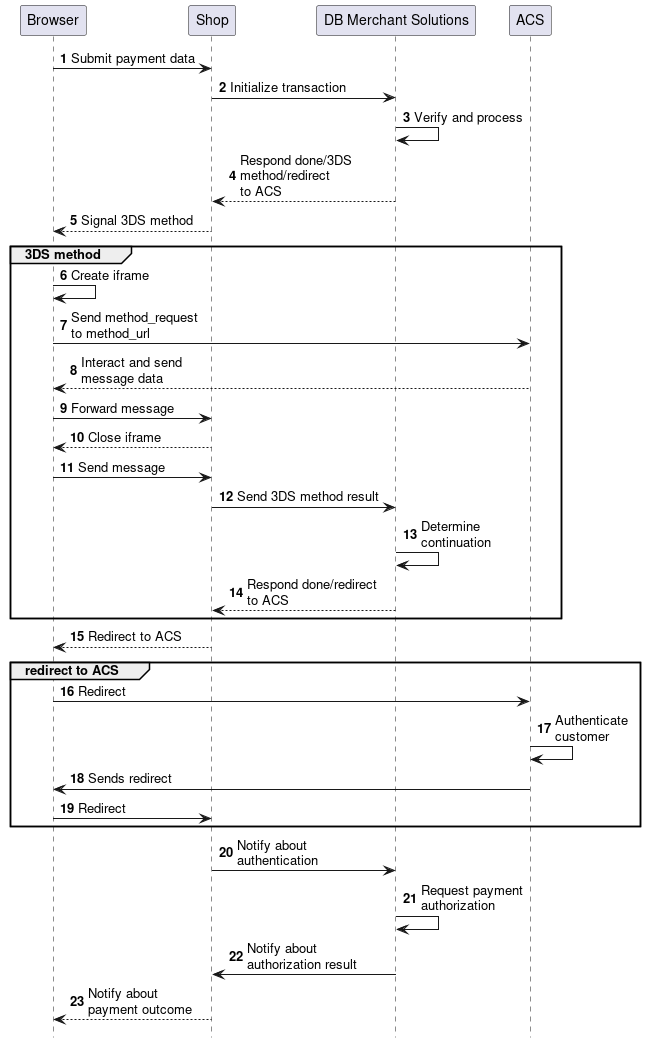

Whenever possible, credit card payments are carried out as 3-D Secure transactions. In this case the communication with the Directory Server and the Access Control Server (ACS) (see section Course of transaction) takes place between step 7 and step 8 of the subsequent diagram and is not shown in the illustration. In the case of the Form service all activities specific to the 3-D Secure procedure are handled by DB Merchant Solutions without involving your application.

For 3-D Secure transactions, the fields given in 3DS required fields are required.

The Form service supports the so-called uplift feature for missing fields.

This feature determines the technical fields

(such as device_information.ip_address) and requests any missing non-technical fields

(such as customer_data.cardholder_email) from the customer by displaying additional input fields.

3.2.8. Course of transaction

The course of transaction for the different payment methods or services is similar but not quite identical.

Form service

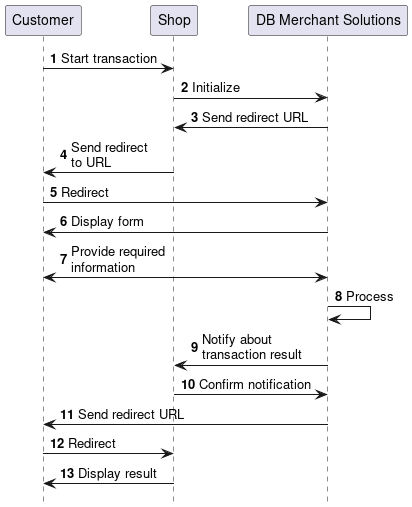

The following diagram shows a simplified course of transaction of the Form service in a sequence diagram. For simplification the merchant’s application is called shop and in the following is highlighted in bold.

Further details regarding the individual steps are given below.

-

The customer makes a purchase in the shop and starts the payment or payment-related process.

-

The shop generates a request and sends a request to DB Merchant Solutions, see Initializing the Form service payment for details.

-

In its response DB Merchant Solutions sends the Form service URL to the shop. If there is an error DB Merchant Solutions sends an error message to the shop instead.

-

The shop sends a redirect to the Form service URL to the customer’s browser.

-

The customer’s browser redirects to the Form service URL.

-

DB Merchant Solutions displays a website to provide necessary details about the transaction by the customer. respectively for the customer.

-

The customer provides the necessary information to DB Merchant Solutions.

-

DB Merchant Solutions Processes the transaction.

-

DB Merchant Solutions notifies the shop about the transaction result. The URL supplied in the initialization request is used for this (

notify_url). This step and step 10 are skipped if you submit theskipparameter in the initial request. In this case your application has to send a status request to DB Merchant Solutions for finding out the outcome of the payment. For details see Callback and diagnosis request. -

The shop confirms receipt of the notification.

-

As response to step 7 DB Merchant Solutions sends a redirect response to the customer’s browser. The redirect URL contains one of

success_url,error_url, ornotification_failed_urlwhich have been configured in the initialization request. For details see Redirect to merchant’s website. -

The customer clicks the link “back to the shop”, or the customer’s browser redirects to the shop.

-

The shop displays the transaction result for the customer.

Details on the individual steps:

-

In some situations, DB Merchant Solutions communicates with a backend system, for example to create an order entity.

-

In some situations, the redirect URL points to a payment method’s website and not to DB Merchant Solutions

-

The communication may be more complex than just submitting a form.

-

In most cases, processing includes communication with the backend systems. In some cases further customer interaction is involved.

Handling of timeouts

If a timeout occurs in step 7, that is the customer does not complete providing the required information within 30 minutes, DB Merchant Solutions notifies the shop as in step 9 about the timeout.

If the customer continues the dialogue after that time, they get an error message.

3.2.9. Initializing the Form service payment

You transfer the transaction data without the data of the payment method and receive a link (Form service URL) to DB Merchant Solutions as response (see an example below and Forms for details). Then you send a redirect to the Form service URL to your customer. This may be via HTTP redirect header, an HTML page with a meta tag, or a JavaScript form. The payment is made once DB Merchant Solutions has displayed for the customer the form to enter the credit card details and bank details respectively, and the completed form has been returned to DB Merchant Solutions.

Already when initializing the payment your application transmits up to 3 URLs to DB Merchant Solutions, which DB Merchant Solutions directs the customer to after concluding the payment. Which one of the supplied URLs is used depends on the outcome of the payment.

Required fields

The following parameters are required for the checkout page (where the customer chooses the payment method) and for each Form service endpoint where a payment method is preselected:

-

amount_totaland subfields, -

form_customer_continuationand subfields (see Redirect to merchant’s website), -

callbackand subfields (see Callback and diagnosis request).

The following parameters are required for the checkout page to specify and configure the payment methods offered to the customer:

-

checkout_page_configurationwith-

subfield

sorting_ordercontaining an entry for each offered payment method, -

a subfield ending with

_datacontaining the configuration specific to the offered payment methods (likegoogle_pay_credit_card_datafor Google Pay).The payment methods in

sorting_orderand the payment methods' configuration fields must coincide.

-

For required fields which are specific to a payment method refer to the corresponding section in Payment methods:

Alias

If your account is configured to use card number aliases you can

-

register a card number alias together with the payment by submitting the field

alias_actionwith theactionCREATE. Enter the desired alias inalias. If you leavealiasempty, DB Merchant Solutions will generate a card number alias for you. -

register a credit card number alias without a payment. By submitting the

tx_actionverify-mopand an amount of 0 you can tell DB Merchant Solutions to display the text for registering a card number alias in the form. Setadditional_datato a unique value to later match the callback (see Callback and diagnosis request) to the initial request. -

carry out a payment with a card number alias you have already registered. To do so, submit the card number alias in the

means_of_paymentaliasfield. DB Merchant Solutions will find the details of the credit card or bank account corresponding to this alias and display these in the payment form. In this case, the only remaining input field the customer has to fill out is the card number verification code in the case of a credit card payment.

Credit card 3-D Secure 2.1 or 2.2 transactions

Submit credit_card_data.tds_20_data to carry out a 3-D Secure 2.1 or 2.2 credit card payment. tds_20_data includes

numerous 3-D Secure related parameters some of which are optional. The credit card issuer uses many of these

parameters to assess the risk of a payment default and to decide if the cardholder is required to carry out a

two-factor-authentication. We recommend submitting these parameters as far as the data are available. Information about

the cardholder (parameters in cardholder_account_info) and the shipping address

(parameters in shipping_address inside customer_data) are especially important.

You can contact Deutsche Bank customer support if you have further questions about the parameters.

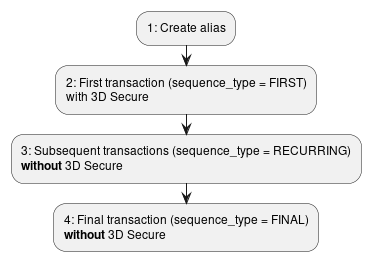

In the case of recurring payments it is possible to carry out the first transaction

as a 3-D Secure 2.1 or 2.2 payment and the subsequent transactions without 3-D Secure.

Recurring 3-D Secure 2.1 or 2.2 payments require additional parameters:

-

series_flag: possible values:RECURRING, for example in the case of a subscription or standing order orUCOFwhen a card number alias is created for future payments with the same credit card. In this case usealias_actionwith theactionCREATEwith the first payment and the card number alias with the following payments. You can specify thetx_actionverify-mopfor the first UCOF transaction to register a card number alias without a payment. -

sequence_type: possible values:FIRSTfor the first payment,RECURRINGfor the following payments,FINALfor the last payment. -

recurring_payment: recurring payment identifier. Optional field for the first payment. If not submitted DB Merchant Solutions generates an identifier. The fieldrecurring_paymentthat is contained in the response of the first payment has to be submitted with all following payments of this recurring payment. -

recurring_expiryintransaction_attributes: date after which no further authorizations shall be carried out. -

recurring_frequencyintransaction_attributes: minimum number of days between authorizations

Example: Request body to initiate a Form service direct debit payment and response

See SDD request example for an example of a request to initiate a SDD transaction. Redirect the customer to the redirect_url contained in the response.

3.2.10. Processing after transaction

With Form service, a transaction is initialized by a merchant, but the necessary customer interaction is handled by a hosted page of DB Merchant Solutions.

After the transaction, two things have to be done:

-

Pass the control back to the merchant’s website ("redirect"),

-

inform the merchant’s backend about the outcome of the transaction (success or error).

Mind, that 2. should not depend on 1. to make sure that the merchant is informed even if (for example) the browser is closed.

All requests in Forms API contain the fields

form_customer_continuation referring to 1. and

callback referring to 2.

Redirect to merchant’s website

To pass the control from DB Merchant Solutions to the merchants' website,

three redirect URLs are specified in the field form_customer_continuation:

-

success_urlfor successful transaction (required), -

error_urlif the transaction failed, -

notification_failed_urlif the callback notification failed. In this case, the transaction itself may have succeeded or failed. To distinguish these two cases, the merchant had to call the diagnosis request to inform the customer correctly.notification_failed_urlis not used for"skip": truein Callback.

error_url and notification_failed_url default to success_url if omitted.

form_customer_continuation also has the subfield redirect. When set to true, the redirect takes place

directly after the transaction. When set to false, the customer is shown an intermediary page

(hosted by Form service) which contains a link to the redirect url.

The behaviour for the payment link endpoint is different

(see Using a payment link).

The field form_customer_continuation is required in all endpoints of Form service,

but not for the

payment link endpoint (see Using a payment link).

Callback and diagnosis request

To get notified about the outcome of the transaction merchants may either

-

use the Callback mechanism get a message from DB Merchant Solutions to a URL they provide ("push"), or

-

use diagnosis request to "pull" the information themselves (mind the restriction on the number of requests given there).

Both is configured in the field callback of the request bodies

of the Form service: notify_url contains the merchant’s endpoint

for push. If pull is used, the callback must be skipped by setting "skip": true.

In this case notify_url can be omitted.

The field callback is required in all endpoints of Form service,

and also in

the payment link endpoint (see Using a payment link).

In case of using the callback option, the endpoint (with URL notify_url) needs to be implemented according to the

description in Callback.

Make sure to verify the integrity of

the callback by verifying its signature, see Verifying callback requests for details.

The parameter event_id

(available for all requests except for creating an alias) is used

to match the callback with the corresponding initialization request.

The parameter callback.additional_data

(available for all requests) is also returned in the callback request and can be used for matching.

When using callback.additional_data, make sure to set a unique value.

The event_id is also used to identify the transaction in the diagnosis request

(also see Diagnosis request).

3.2.11. Using a payment link

Background

The Form service endpoints support an immediate payment by the customer. For some use cases, it is desirable to have a delayed payment.

For example, a merchant may request payment after shipping by sending an email containing a payment link which directs the customer to a Form service endpoint. Similarly, a merchant may send a printed invoice which contains this link as a QR code.

The payment link supports the same payment methods as the Form service. These are:

-

credit cards: Mastercard and Visa

-

Google Pay

-

Apple Pay

-

SEPA Direct Debit (SDD)

-

PayPal

-

Request to Pay

-

Klarna

-

P24

-

WeChat Pay

-

iDEAL

-

TWINT

-

Wero.

The payment link supports the transaction kinds authorization and pre-authorization.

DB Merchant Solutions REST API provides the following "create, read, update, delete" functionality for payment links:

-

Create a payment link. The created payment link directs the customer either to the checkout page with payment method selection or directly to a payment method specific form.

-

Get information about a payment link.

-

Update a payment link.

-

Deactivate a payment link.

Creating a payment link

Use the create payment link endpoint to receive a link to a Form service checkout page on which the customer may pay.

Fields of the request

The request body of the endpoint has the following fields:

-

All the fields of the Form service checkout page. In particular, all payment methods and all customizing options which are available in the Form service checkout page can also be used for the payment link.

-

expires: specifies until when the payment link is valid and usable.expiresmust be in the future and must not be more than 60 days in the future.

The following fields are required:

-

amount_totalwith the subfieldsamountandcurrencybeing set, -

checkout_page_configuration, -

expires, -

callback.

The handling of the field form_customer_continuation differs from the Form service endpoints:

form_customer_continuation is not required. If the field is omitted, a

message "You may close the window now." is displayed after the transaction.

The other fields are either required depending on the offered payment methods or optional. They allow for customization and an enhanced customer experience. See Form service required fields for which fields are required.

Course of transaction

When a customer uses a payment link, DB Merchant Solutions REST API behaves as follows:

-

If the link is expired, has been deactivated, or the corresponding payment has already taken place, DB Merchant Solutions REST API displays a corresponding message to the customer. In particular, the payment is no longer possible.

-

Otherwise, DB Merchant Solutions REST API proceeds as follows:

-

If only one payment method is offered by the payment link, DB Merchant Solutions REST API directly displays the corresponding form of the payment method without a prior selection of payment methods. Note that Apple Pay is available on Safari devices only, which is why when a payment link with only Apple Pay as a payment method will result in an error on non-Safari devices.

-

Otherwise, that is more than one payment method is offered by the payment link, DB Merchant Solutions REST API will display the DB Merchant Solutions REST API checkout page with payment method selection.

-

In both cases, the transaction proceeds as the corresponding Form service transaction. In particular, set callback.notify_url to receive a callback about the outcome of the payment or set callback.skip = true to not receive such a callback (in this case, use the payment link information endpoint to get information about the status of the payment link).

Getting information about a payment link

Use the payment link information endpoint to retrieve information about the payment link. In particular, payment_link_info.status will contain the status of the payment link (initialised, deactivated, expired, or payment successful) and payment_link_info.expires the expiry date and time.

Extending the validity period of think the link

Use the update payment link endpoint to set a new validity period (parameter expires).

Deactivating the link

Use the deactivate payment link endpoint to deactivate (immediately) a payment link.

3.3. iFrame Service

The iFrame Service offers almost complete control over the appearance of the form into which your customers enter their credit card or bank account details as well as the benefit that your shop does not get into contact with the means of payment details. Generally this makes it considerably easier for your shop to comply with the "Payment Card Industry Data Security Standard" (PCI DSS).

3.3.1. Course of transaction

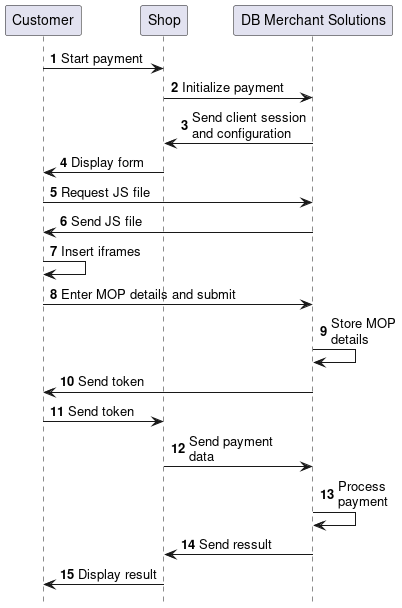

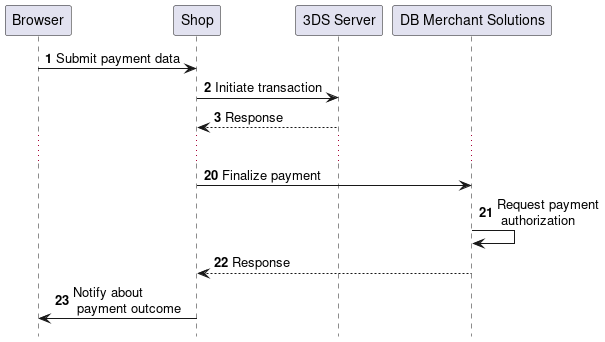

The following diagram shows an example of a payment transaction in the form of a sequence diagram.

The transaction proceeds as follows:

-

The customer makes a purchase in the shop and starts the payment process.

-

The shop initializes the payment with DB Merchant Solutions.

-

In the response DB Merchant Solutions sends a session ID and configuration data to the shop.

-

The shop displays a page to the customer which contains placeholders for the input fields of the means of payment details and JavaScript code.

-

This page requests a JavaScript file from DB Merchant Solutions.

-

DB Merchant Solutions sends the JavaScript file to the customer’s browser.

-

With the help of this JavaScript file the browser replaces the placeholders with iframes to enter the means of payment details.

-

The customer enters the means of payment details and submits the form.

-

DB Merchant Solutions stores the means of payment details.

-

DB Merchant Solutions sends a token to the customer’s browser.

-

The browser sends the token to the shop.

-

The shop sends all data required for payment, including the token, to DB Merchant Solutions.

-

DB Merchant Solutions processes the payment.

-

DB Merchant Solutions sends the result of the payment to the shop.

-

The shop displays the payment result to the customer.

For credit card or Maestro payments with 3D Secure, additional steps take place which are not shown in the diagram. You do not have to consider these additional steps during integration.

To integrate the iFrame Service, your shop has to send requests to the DB Merchant Solutions REST API (step 2 and step 12).

Moreover you have to implement HTML and JavaScript code to enable DB Merchant Solutions to display the iframes with the input fields and to enable DB Merchant Solutions to create a token with the customer’s means of payment data.

The details are described in the following sections.

3.3.2. Use of cookies

The iFrame Service uses session cookies, which are first-party cookies and are strictly necessary in the sense of the General Data Protection Regulation (GDPR), which is applicable in the European Union and the UK. As the cookies do not gather personal information, a user consent therefore is not required.

3.3.3. Payment initialization

See Services API for details about the request and response entities to initialize an iFrame Service interaction. See iFrame Service initialization example for an example request.

The response will contain the fields client_session, client_configuration, rc, and message.

The values of the response parameters client_session and client_configuration are required for the JavaScript code of the payment form.

3-D Secure 2.1 or 2.2

Set the tds_20_data values (in IFrameInitializeRequest) to carry out a 3-D Secure 2.1 or 2.2 transaction.

See 3DS required fields for the required and optional subfields of tds_20_data.

The credit card issuers use many of these parameters to assess the risk of a payment default and to decide if the cardholder is required to carry out a two-factor-authentication.

We recommend submitting these parameters if available. Information about the cardholder and the shipping address (in TDS20CustomerData) is especially important. You may also contact your acquirer if you have further questions about the parameters.

|

The 3-D Secure 2.1 or 2.2 related parameters are subject to change of the EMVCo 3-D Secure specification. |

Obtaining the CVV for credit card aliases

DB Merchant Solutions REST API supports creating aliases for credit card numbers, see Aliases. For security reasons, DB Merchant Solutions is not permitted to store the card verification value (CVV) with an alias for a credit permanently. Only short-term storage is possible.

To obtain the CVV for a credit card alias and then conduct a credit card payment, use the iFrame Service as follows.

-

Initialize an iFrame service interaction as for a credit card transaction, in particular regarding 3-D Secure 2.1 or 2.2.

-

In the HTML page (see Necessary HTML), insert a div with ID

iframeCvc. -

In the JavaScript (see Necessary JavaScript), set

typetoaliasCreditCard. -

To pay (see Paying with the received token), use the credit card payment endpoint and set the parameters as follows:

-

alias_action.action=USEandalias_action.aliasto the alias to be used -

means_of_paymentto the received token.

-

For bank account aliases, a CVV is not necessary.

3.3.4. Necessary HTML

Provide an HTML element for every input field that has to be replaced by an iframe, for example a div with an ID. With the ID you can reference the element in the JavaScript code in the options object (see Options).

If you accept both credit card and direct debit payments, you can either create separate forms for credit card and bank account details or a combined form for both transaction kinds. In the latter case the customer decides if they want to pay by credit card or direct debit by filling out the credit card or bank account details in the form.

The following example shows an excerpt from an HTML form for credit card details.

In the div elements with the IDs iframeHolder, iframePan, iframeExpiry, and iframeCvc, DB Merchant Solutions will inject iframes later.

<form action="/shop-receive-token" id="panForm">

<div>

<div>

<label for="iframeHolder">Card holder</label>

<div id="iframeHolder"></div>

</div>

</div>

<div>

<div>

<label for="iframePan">Card number</label>

<div id="iframePan"></div>

</div>

</div>

<div>

<div>

<label for="iframeExpiry">Expiry date</label>

<div id="iframeExpiry"></div>

</div>

<div>

<label for="iframeCvc">Card verification code</label>

<div id="iframeCvc"></div>

</div>

</div>

</form>3.3.5. Necessary JavaScript

Your HTML page to enter the means of payment details has to load the JavaScript file integration.js from DB Merchant Solutions. You can implement this for example by means of a script tag:

<script src="https://merch.directpos.de/web-ifs/assets/1.2/integration.js"></script>The script is also available on the test system under the following URL:

You can initialize this script for example like this:

document.addEventListener("DOMContentLoaded", function (event) {

//...

var options = {

//...

};

integration.initialize(options).then(function (ifsInstance) {

//do something...

});

//...

});The options object mentioned in the example is described below in Options.

You can use instead jQuery to integrate integration.js as follows:

$.getScript("https://testmerch.directpos.de/web-ifs/assets/1.2/integration.js", function () {

//...

var options = {

//...

};

integration.initialize(options).then(function (ifsInstance) {

//do something...

});

//...

});Options

The options object consists of the following fields:

-

client_sessionis the session ID -

client_configurationcontains encoded configuration data

You received the values of these two fields from DB Merchant Solutions in the response of the initialization.

-

typecontains the type of means of payment, eithercreditCardfor credit card or Maestro payments,bankAccountin the case of direct debit transactions oraliasCreditCardif the payment is carried out with an alias for a credit card. -

fields: see Fields -

styles: see Styling -

acs_windowoptional, for credit card payments. Contains the fieldswidthandheight(see Examples). You can specify width and height (in pixels) of the pop-up window which the Access Control Server (ACS) displays to the customer to authorize a 3-D Secure payment. If not specified, a square window with width and height of 400 pixels will be displayed.

var options = {

clientSession: clientSession,

clientConfiguration: clientConfiguration,

type: typeOfPayment,

fields: {

//...

},

styles: {

//...

}

};Fields

This object is used to configure the input fields.

Which input fields have to be included in fields depends on the type of means of payment (parameter type), see below.

See Parameters for each input field for which parameters need to be configured for each input field.

See Examples for examples of each type.

-

number: card number. Up to 19 digits. integration.js includes spaces to improve readability. -

expiry: month and year of the expiration date of the card, formatted MM/YY. -

code: card verification code. Three to four digits. -

holder: name of the cardholder.

The fields number and expiry are required.

For a standard transaction, that is, in the initialization of the iFrame Service the field processing_options was not set, the field code is required. For a mail order / telephone order transaction, that is, in the initialization of the iFrame Service the field processing_options was set to MOTO, the field code is not required.

The field holder is not required in the form for credit card or Maestro payments.

-

holder: name of the account holder. -

iban: international bank account number IBAN. Up to 34 characters. integration.js includes spaces to improve readability. -

bic: business identifier code BIC. 11 characters. Only has to be filled out if the customer has a bank account in a SEPA country outside the EU.

If your shop accepts international direct debit transactions, all three fields have to be present in the form. For German direct debit transactions the field for the BIC is not required.

-

code: card verification code. Three to four digits.

The following parameters serve to configure the input fields:

-

selector: required. Used to reference the placeholder for the iframe. -

placeholder: text of the placeholder attribute in the input field. If not provided, no placeholder text will be displayed. -

required: applicable for the credit card fieldscode(for non-MOTO transactions) andholder. An input value is required iftrue. Possible values:true,false. Defaults aretrueforcodeandfalseforholder.

Styling

You can use CSS to design the forms as you like.

You cannot style the content of the iframes directly via CSS, but you can inject CSS specifications into the iframe via JavaScript.

To do so, specify the CSS rules as JSON object and add the styles parameter to the injected configuration object.

See Examples for an example.

The iFrame Service uses the following CSS classes for the input fields:

| CSS class | Explanation |

|---|---|

|

denotes a field with valid input |

|

denotes a field with invalid input |

|

denotes a field with possibly valid input |

|

denotes a field with input that is not accepted, for example credit card brand |

|

denotes a field which has the focus |

|

denotes a required field |

The iFrame Service supports the following CSS attributes to format the iframes.

| CSS attribute |

|---|

-moz-appearance |

-moz-osx-font-smoothing |

-moz-tap-highlight-color |

-moz-transition |

-webkit-appearance |

-webkit-font-smoothing |

-webkit-tap-highlight-color |

-webkit-transition |

appearance |

color |

background |

background-color |

background-image |

background-origin |

background-position |

background-repeat |

background-size |

background-attachment |

direction |

font |

font-family |

font-size |

font-size-adjust |

font-stretch |

font-style |

font-variant |

font-variant-alternates |

font-variant-caps |

font-variant-east-asian |

font-variant-ligatures |

font-variant-numeric |

font-weight |

letter-spacing |

line-height |

opacity |

outline |

text-shadow |

transition |

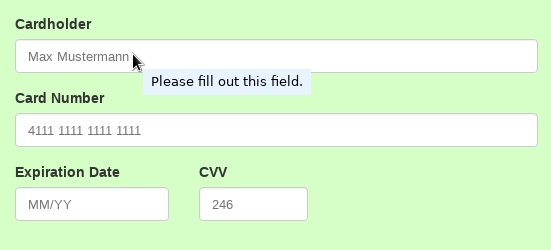

Examples

var options = {

clientSession: clientSession,

clientConfiguration: clientConfiguration,

type: 'creditCard',

fields: {

holder: {

selector: '#iframeCardholder', placeholder: 'Max Mustermann',

required: false

},

number: {selector: '#iframePan', placeholder: '4111 1111 1111 1111'},

code: {selector: '#iframeCvc', placeholder: '246'},

expiry: {selector: '#iframeExpiry', placeholder: 'MM/YY'}

},

acs_window: {

width: 700,

height: 600

}

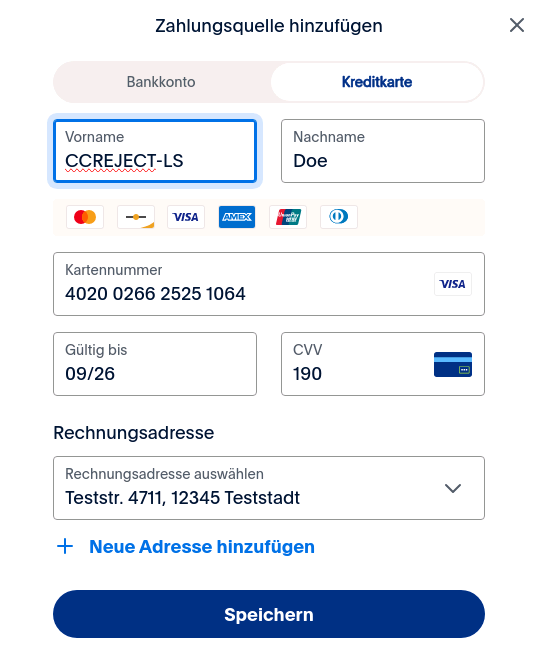

};The following image shows an example form after the execution of the integration.js script.

var options = {

clientSession: clientSession,

clientConfiguration: clientConfiguration,

type: 'bankAccount',

fields: {

holder: {selector: '#iframeAccountHolder', placeholder: 'Max Mustermann'},

iban: {selector: '#iframeIban'},

bic: {selector: '#iframeBic'}

}

};var options = {

clientSession: clientSession,

clientConfiguration: clientConfiguration,

type: 'aliasCreditCard',

fields: {

code: {selector: '#iframeCvc', placeholder: '246'},

},

acs_window: {

width: 700,

height: 600

}

};The following example shows how the CSS rules are defined and added to the options object.

var styles = {

"input": {

"font-size": "16px",

"color": "#444444",

"font-family": "monospace"

},

".ifs-valid": {

"color": "Green"

},

".ifs-invalid": {

"color": "Crimson"

},

".ifs-not-accepted": {

"color": "DarkGoldenRod"

}

};

var options = {

clientSession: clientSession,

clientConfiguration: clientConfiguration,

type: 'bankAccount',

fields: {

holder: {selector: '#iframeAccountHolder', placeholder: 'Max Mustermann'},

iban: {selector: '#iframeIban'},

bic: {selector: '#iframeBic'}

},

styles: styles

};Events

The iFrame Service uses JavaScript events extensively. You can handle the following events in your script:

| Event | Explanation | Example of use |

|---|---|---|

|

the credit card brand changed |

display an image of the card brand |

|

the country of the IBAN changed |

display the flag of the country |

|

the validation status of an input field changed |

change the colour of the input field |

|

the validation status of the entire form changed |

change the colour of the form |

|

the focus of an input field changed |

change the colour of the input field |

|

the state of the form changed from active to inactive or vice versa |

change the colour of the form |

|

the user pressed the enter key in an input field |

handle form submission |

|

style specification of an input field changed |

forward to parent elements |

Subscribing to events

To subscribe to the events mentioned above, call the on method of the ifsInstance with two parameters:

-

name of the event

-

function with the event payload as parameter

integration.initialize(options).then(function (ifsInstance) {

ifsInstance.on('submitRequest', function (event) {

//submit stuff...

});

ifsInstance.on('cardBrandChange', function (event) {

//card type change stuff...

})

});Standard events

Some events are handled by the DB Merchant Solutions script. You do not have to handle these events yourself.

| Event | Behaviour |

|---|---|

|

add or remove a CSS class of the iframe placeholder |

|

sets the CSS class denoting an element in focus on the iframe placeholder which has the focus |

Payloads of the events

cardBrandChange

type is the brand name of the card.

Possible values are mastercard, visa, amex, diners, discover, jcb or maestro. fields contains the label of the input field for the card verification code.

Since the credit card organizations use different names for the card verification code (CVC, CVV, …) you can use this text to change the label of this input field.

var eventPayload = {

"type": "visa",

"fields": {

"code": {"label": "CVV"},

}

}ibanTypeChange

type is the country code of the submitted IBAN.

fields contains information about the IBAN.

For example, you can use the bicMandatory parameter to show or hide the input field for the BIC.

var eventPayload = {

"type": "DE",

"fields": {

"enabled": true,

"code": "DE",

"name": "Germany",

"pattern": "DE{{nn}}{{nnnnnnnn}}{{nnnnnnnnnn}}",

"length": 22,

"checksum": true,

"sepa": true,

"bicMandatory": false

}

}validationChange

validation contains information about the current validation status of the input field.

It consists of the parameters valid - the field is valid, potentialValid - the field contains no invalid characters or the like, accepted - the credit card or IBAN is accepted, and completed - the field has been filled out (in case of a required field).

field describes the input field which was validated.

var eventPayload = {

"validation": {

"valid": false, "potentialValid": false, "accepted": true,

"completed": true

},

"field": {"name": "number", "label": "Card Number", "selector": "#iframePan"}

}formValidationChange

The payload specifies if the form is valid (valid) and if all required fields have been filled out (completed).

var eventPayload = {"valid": false, "completed": true}focusChange

After the focus has changed this should be forwarded to the elements that include the iframe.

The payload of this event contains the necessary information.

The focused parameter specifies if the input field has the focus or not.

The field parameter describes the input field.

var eventPayload = {

"focused": false,

"field": {"selector": "#iframePan", "label": "Card Number", "name": "number"}

}activeStateChange

The payment page can contain more than one form, for example one form to enter credit card details and another form to enter bank account details. In this case the form which is currently active has to be marked. The payload of this event indicates if the instance is currently active.

var eventPayload = {"isActive": true}submitRequest

This event is triggered if the enter key is pressed in an iframe field.

The payload includes the field and the ASCII code of the key that was pressed.

var eventPayload = {

"field": {"name": "number"},

"key": 13

}Submitting the form

Check if the form is active and has been completely filled out with valid values. If this is the case you can have DB Merchant Solutions generate the token for the payment.

The following sample code shows how you can implement the submitFunction:

function submitFunction(ifsInstance) {

return function _innerFunction(event) {

//prevent if not active or invalid

if (event instanceof Event) event.preventDefault();

if (!ifsInstance.isActive() || !ifsInstance.isValid()) return;

ifsInstance.createToken(function (createTokenErr, createTokenResponse) {

if (createTokenErr) {

alert(createTokenErr);

return;

}

$.post("/shop-receive-token",

{

token: createTokenResponse.token,

},

function (data, status) {

//...

});

});

}

}Subscribing to the event:

integration.initialize(options).then(function (ifsInstance) {

//...

// for typing enter in input fields

ifsInstance.on('submitRequest', submitFunction.call(this, ifsInstance));

// sending submit within another form (by pressing a submit button)

submitForm.addEventListener('submit', submitFunction.call(this, ifsInstance), false);

//...

});Response

As response to submitting the form, you receive the object createTokenResponse which contains the following data:

-

token: the token for the entered data -

type:creditCardorbankAccount -

info: details, either creditCard or bankAccount-

creditCard

-

holder: optional, cardholder -

brand: credit card brand, for example Visa, MasterCard -

expirydate of the card, formatted MM/YY -

paddedPan: masked card number -

tx3DSecureAuthLevel: possible values:-

full3-D Secure authentication -

attempt: 3-D Secure authentication attempted -

sslfallback: no 3-D Secure authentication

-

-

-

bankAccount

-

holder: account holder -

paddedIban: masked IBAN

-

-

In the type parameter, you receive the information whether the customer submitted credit card or bank account details.

If you display a combined form for credit card and bank account details to the customer, the type parameter tells you if you have to carry out a credit card or direct debit payment.

The info object includes additional details.

3.3.6. Paying with the received token

After receiving the token you can carry out the payment using the Payments API. Depending on whether the token was generated for a credit card or a bank account, carry out the payment as a credit card or direct debit payment. You can choose between the transaction kinds authorization or pre-authorization and capture. These transaction kinds are described in Transactions kind details.

3.3.7. Bigger Example

The subsequent example contains HTML and JavaScript code for a page with two forms to enter credit card and bank account details.

<!-- ... -->

<form action="/shop-receive-token" id="panForm">

<div>

<div>

<label for="iframeCardholder">Cardholder</label>

<div id="iframeCardholder"></div>

</div>

</div>

<div>

<div>

<label for="iframePan">Card Number</label>

<div id="iframePan">

<div id="cardImage"></div>

</div>

</div>

</div>

<div>

<div>

<label for="iframeExpiry">Expiration Date</label>

<div id="iframeExpiry"></div>

</div>

<div>

<label for="iframeCvc">CVV</label>

<div id="iframeCvc"></div>

</div>

</div>

</form>

<!-- ... -->

<form action="/shop-receive-token" id="bankAccountForm">

<div>

<div>

<label for="iframeAcctHolder">Account Holder</label>

<div id="iframeAcctHolder"></div>

</div>

</div>

<div>

<div>

<label for="iframeIban">IBAN</label>

<div id="iframeIban"></div>

</div>

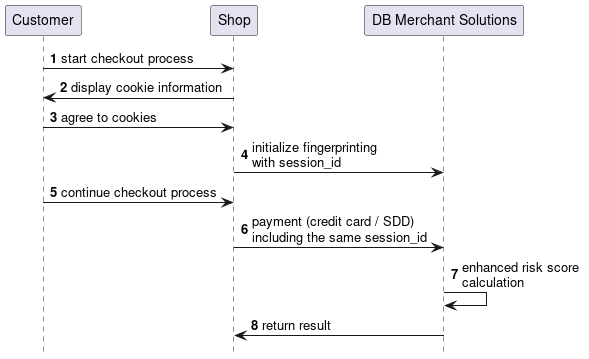

</div>